Investment Newsletters

Meeder News

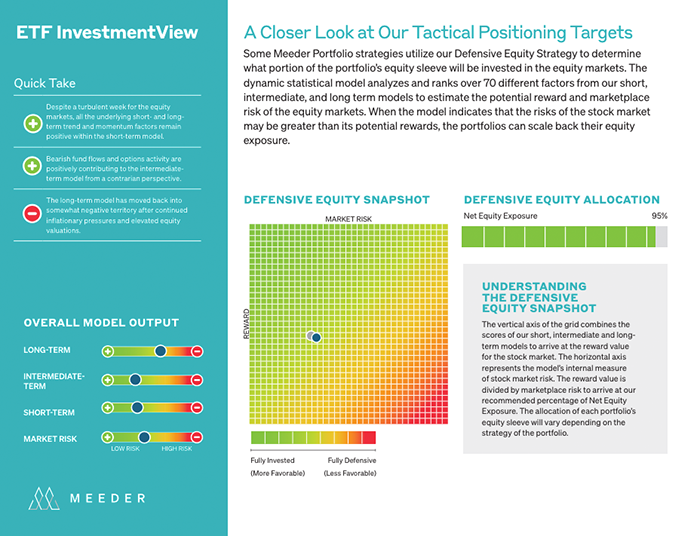

Some Meeder Portfolio strategies utilize our Defensive Equity Strategy to determine what portion of the portfolio’s equity sleeve will be invested in the equity markets. The dynamic statistical model analyzes and ranks over 70 different factors from our short, intermediate, and long term models to estimate the potential reward and marketplace risk of the equity markets. When the model indicates that the risks of the stock market may be greater than its potential rewards, the portfolios can scale back their equity exposure.

Learn about Meeder Wealth Management's affiliation with Summit Financial, one of the industry's prominent independent advisory firms.